Investing in Early Stage Businesses

Posted on 29. Jun, 2011 by TheFreeInvestor in General, Investing Philosophy

As I mentioned in my post about high quality business, I am a fan of technology enabled disruptive businesses, especially in their early stages when the company is growing rapidly. Of course, early stage companies are riskier than mature companies. So, we need to keep the portfolio allocation at a level that is commensurate with our risk tolerance. When I say risk, I don’t mean the volatility in stock price. I mean the risk of permanent loss of capital. As a long term investor, the stock price volatility means little to me. The fluctuations in stock price matters more and more as we get closer to the time when we need to liquidate the investment for some life event or any other cashflow need.

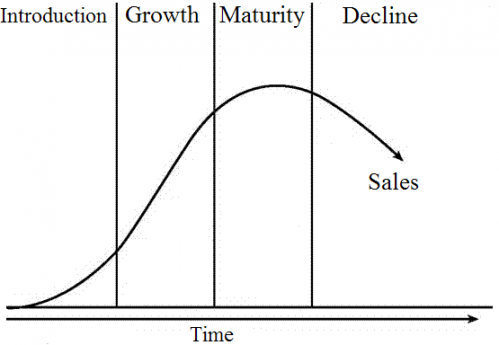

Investing in early stage (i.e., introduction and growth stages in the picture above) of a company with great growth potential can be very rewarding if the portfolio of such companies is not limited to a very small set. Let’s apply one of the Peter Lynch quotes to explore this aspect. Peter Lynch famously said – “In this business, if you’re good, you’re right 6 times out of 10. You’re never going to be right nine times out of 10.” Now, applying that to early stage companies, if your success rate is such that one out of ten investments return 500% or 1000% then that single investment can more than compensate for permanent loss of capital in many other investments. (e.g., with one 1000% gain, you will break-even even if nine other equal investments result in total capital loss.) So, in these cases, the return on investment can be great even if the success rate is less than 6 out of 10 that Peter Lynch mentioned. The key is to have at least few big hits. So, from an approach perspective, it is similar to investments by venture capitalists. For me, Netflix (NFLX), Chipotle Mexican Grill (CMG), Nuance Communications (NUAN) and Ctrip (CTRP) has been few of such investment successes that has more than compensated for numerous bad investments. Of course, we are in a rising market right now and things can turn south anytime. But, I believe, these companies will be winners in long term.

As many of these investments have grown significantly in last five years, recently I have been adding few more such investments to my portfolio in order to position it for future growth. My investment in EnerNOC (ENOC) and Infinera (INFN) fall under this type of early stage investing. I wrote about those positions in my previous post. Similarly, I added Sina (SINA) to my portfolio. Sina is a leading Chinese internet portal. But, the more interesting story recently has been its new micro-blogging service called Weibo — apparently you can say a lot in 140 characters of Chinese script ! Weibo has been adding users at a break-neck pace. At the end of last quarter it had 140 million users and growing rapidly. It is one of the most volatile stocks in my portfolio, especially given the recent concerns around Chinese companies in general. But, as I mentioned volatility in stock price is not a big concern for me. It is still a small part of my portfolio. So, if the investment thesis doesn’t pan out as expected, it will not break my portfolio. I am excited to see how this plays out in coming months and years.

You can see all the companies that I have been watching recently on my watchlist page.

(Disclosure: As of the publication of this post, I hold long position in CMG, CTRP, ENOC, INFN, NFLX, NUAN and SINA. Please read the full disclaimer on this website.)

Trackbacks/Pingbacks

[…] like the sprinkles on a cupcake, these companies are the smallest layer in my portfolio. As I wrote before, recently I have been adding some early stage companies, e.g., EnerNOC (ENOC), Sina (SINA), […]