Bought Initial Position: Discovery Communications (DISCK)

Posted on 23. Jan, 2011 by TheFreeInvestor in Stock Analysis

After cleaning up my portfolio couple of weeks ago, I bought few shares of Discovery Communication Class C shares (DISCK) few days ago. I have been analyzing this company for few weeks now. This investment falls into the same category of Digital Entertainment portfolio that I have been building for sometime. The company has three classes of shares. Voting rights are concentrated in Class B (DISCB) shares which has 10x voting rights and Class A (DISCA) shares have a 1x voting rights. Though Class C (DISCK) shares have no voting rights, those are the cheapest of the three classes (as expected). As I am not concerned with the control of the company, I prefer the cheapest class C (DISCK) shares.

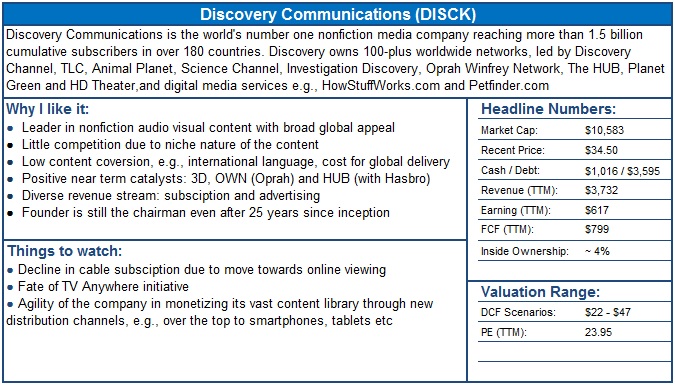

Recently, I started creating short “Investment Thesis Nugget” for each of my investments. Here it is the short overview of my investment thesis:

Business: What do they do?

Discovery Channel was founded by John Hendricks in 1985 as the first cable network in US to focus on creating documentaries about exploring the world. A quarter century later, Discovery owns more than 100 channels, 27 brands in over 180 countries and Hendricks is still the Chairman of the board. Apart from Discovery Channel, some of the other notable channels in US are: TLC, Animal Planet and Discovery Science.

Discovery generates revenue from two primary segments: distribution, and advertising. In the recent nine month period, distribution and advertising attributed for 49% and 43% of the total revenue respectively. The company generates a third of the revenue outside of US. EBITDA margin has been around 38% and generated $799 in free cash flow in last 12 month period.

Positive Catalysts: Why I like it?

- Leadership position in its niche: Today, Discovery is a leader in audio visual content on television. Its content has a broad global appeal as most of the content is documentaries and unrelated to local culture or political issues. Competition in this niche segment of TV programming is very limited though there are some substitutes, e.g., National Geographic and History Channel etc. In the new digital entertainment world, content is going to be the king and Discovery has a lot of high value niche content. So, in long term, the company is poised to benefit from the prospect of international growth and consumption of programs on multiple devices and across multiple channels.

- Low incremental cost: Due to the nature of the content, the cost to convert the content to local languages for international consumption is low. So, the content is highly portable across the globe at a low incremental cost.

- Positive near term catalysts: 3D, OWN, HUB: Early this year Discovery launched OWN (Oprah Winfrey Network) in 50-50 partnership with Oprah and the first 24/7 dedicated 3D channel, 3net, in US by partnering with Sony and IMAX. Discovery has a record of being pioneer in new technologies in television broadcasting. It was one of the first to adopt HD in its early days. Though 3D hasn’t caught the consumer attention fully yet, 3net is a positive step in establishing Discovery’s brand as a leader in adopting new technology. Similarly, launch of OWN is an exciting development. Unlike previous attempts at Oprah channels, this time Oprah seems to be fully committed to the channel. But, its something to watch carefully if she continues to show interest. Finally, the company rebranded the kids channel to HUB by partnering with toy giant Hasbro. Early reviews of the channel have been positive, though still trailing behind Nick and Disney channels by a wide margin. I am excited about this channel due to its joint venture with Hasbro.

- Revenue Diversification: The even distribution of revenue across subscription and advertising gives a good cushion against fluctuations due to economic cycles. In the overall mix, international revenue is more dependent on subscriptions whereas US revenue is more dependent on advertising.

- Founder driven leadership: I love companies where founders are still engaged in the company even after decades of growth. John Hendricks, founder of the company, is still the chairman of the board. David Zaslav has been the CEO since 2007. I like his recent moves to tie up with Hasbro, Oprah and IMAX to launch the three channels mentioned above.

Risks: Things to watch

- Decline in cable subscription: The world of entertainment is moving towards an easier access to TV content on internet. New devices e.g., iPad, Apple TV and Roku boxes are making it more and more feasible to cut the cable television cord. As a significant amount of DISCK revenue comes from cable subscription, this trend towards cord-cutting is disturbing. This trend is still in its infancy and the revenue models of these new world delivery methods are still evolving. I will be keeping an eye on cable companies to see how this plays out and what impact it might have on DISCK bottom line.

- Fate of TV Anywhere initiative: This is risk is related to the previous risk mentioned. TV Anywhere is an initiative started by cable companies to mitigate the threat from Netflix and Hulu etc. The idea is supposed to satisfy the growing trend of consumers wanting to access their TV anywhere and any device they want. We need to see how successful the cable companies are in this effort.

- Ability of monetize content through new channels: We need to watch how the company manages to monetize its vast library of content though the content delivery new channels to smartphones, tablets and computers.

[Photo credit: martymadrid on flickr.com]

[Disclosure: As of the publication of this post, I hold long position in DISCK and NFLX. Please read the disclaimer statements on this site.]