DLB: Profit from Digital Entertainment Trend

Posted on 21. Nov, 2010 by TheFreeInvestor in Stock Analysis

I wrote a detailed overview of the trends in the digital entertainment industry in a previous post. In this context, there is a growing trend towards consumption of more and more rich content at home as well as on portable devices. Dolby Laboratories (DLB) is one of the audio entertainment pioneers that are poised to significantly benefit from the trend of increased home entertainment and increased penetration in emerging markets.

Overview: Why I like it?

The Business: What do they do?

Dolby Laboratories has been developing sophisticated audio entertainment technologies since 1965. The company’s founder and current chairman, Ray Dolby, started the business by creating the Dolby noise reduction system, a sophisticated form of audio compression for reducing background noises of tape recordings. Since that time, as the audio consumption medium continued to evolve, the company kept pace with consistent innovation in improving audio quality and listening experience.

Dolby generates revenue from two primary segments: technology licensing, and products/production services. Technology licensing involves allowing consumer electronics and software forms such as Microsoft, Sony, and Philips to use Dolby’s audio technology in their products. This segment contributed three-fourths of the company’s revenues and a strong 88% of its gross profits in the first three quarters of this year. Most of the revenue from this segment comes from per-unit royalty payments. Therefore, gross margin of the licensing segment of the business is north of 98%. Today, Dolby technologies are standard in a wide range of consumer entertainment devices, including virtually all DVD players, audio/video receivers, and personal computer (PC) software DVD players.

The products and production services group sells sophisticated and expensive audio devices to film studios, theater chains, television broadcasters, cable and satellite television operators. Although this is the smaller part of Dolby’s business, this segments represents the beginning of the “value chain” that links Dolby to the content creators, distributors, and eventually end consumers. Dolby has been successfully leveraging the recent trend of 3D movies. The company’s 3D Digital Cinema solution now enables over 4,000 screens around the world.

The company has a worldwide presence. It sells its products around the world in 85 countries and licenses its technology to consumer electronics companies in 60 countries. Two thirds of the company’s revenue comes from international sales. As the emerging economies grow and their middle classes expand, Dolby will find its way into more households. For example, Brazil’s flat-screen TV market grew 50% in 2009, and thanks to the World Cup, it should grow 69% this year. With Dolby’s technology already in 100% of American and 80% of European digital TVs, the next wave of transitions will make Brazil, Russia, India, and China the top opportunities over the next three to five years.

Dolby’s diverse revenue stream features strong international demand from Windows 7 and 3-D cinema technology, while new avenues for growth include smartphones and tablet notebooks, where Dolby hopes to cement its position as the audio standard. Dolby will benefit from a growing consumer base in emerging markets and TV replacement cycles for years to come.

Financials: How is the financial health?

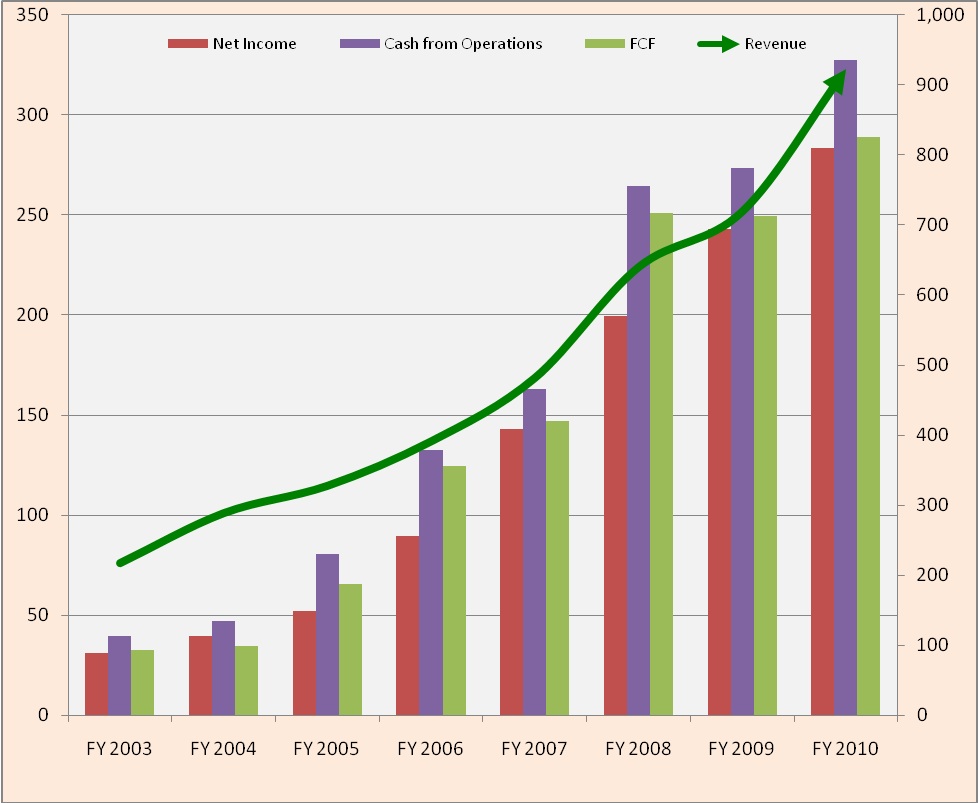

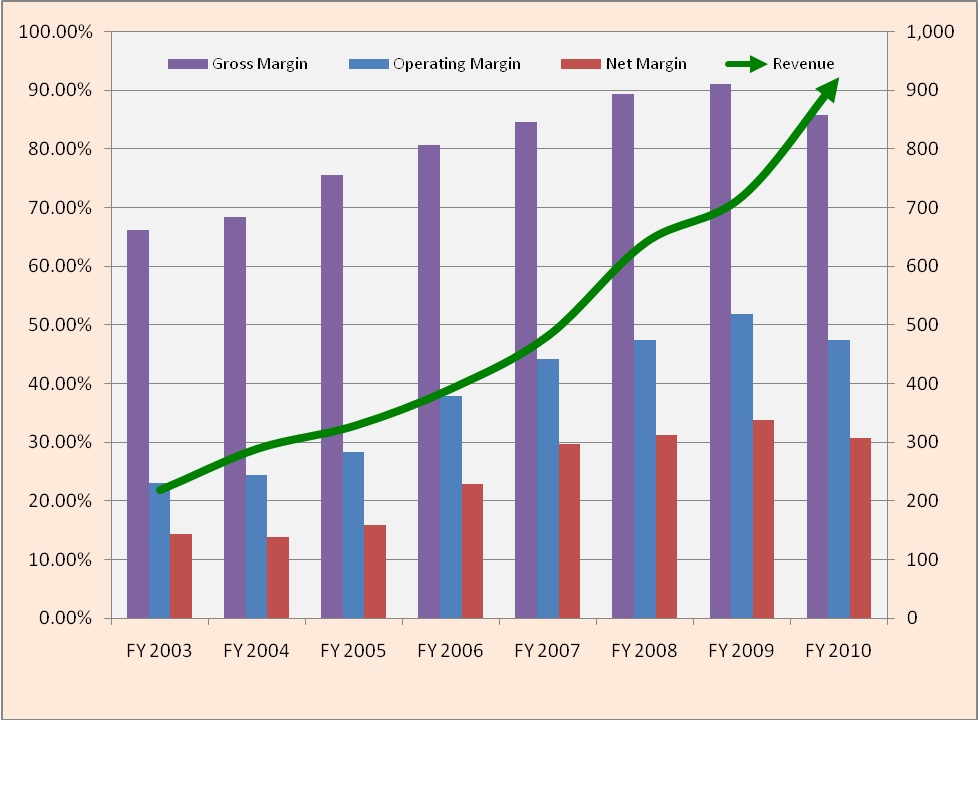

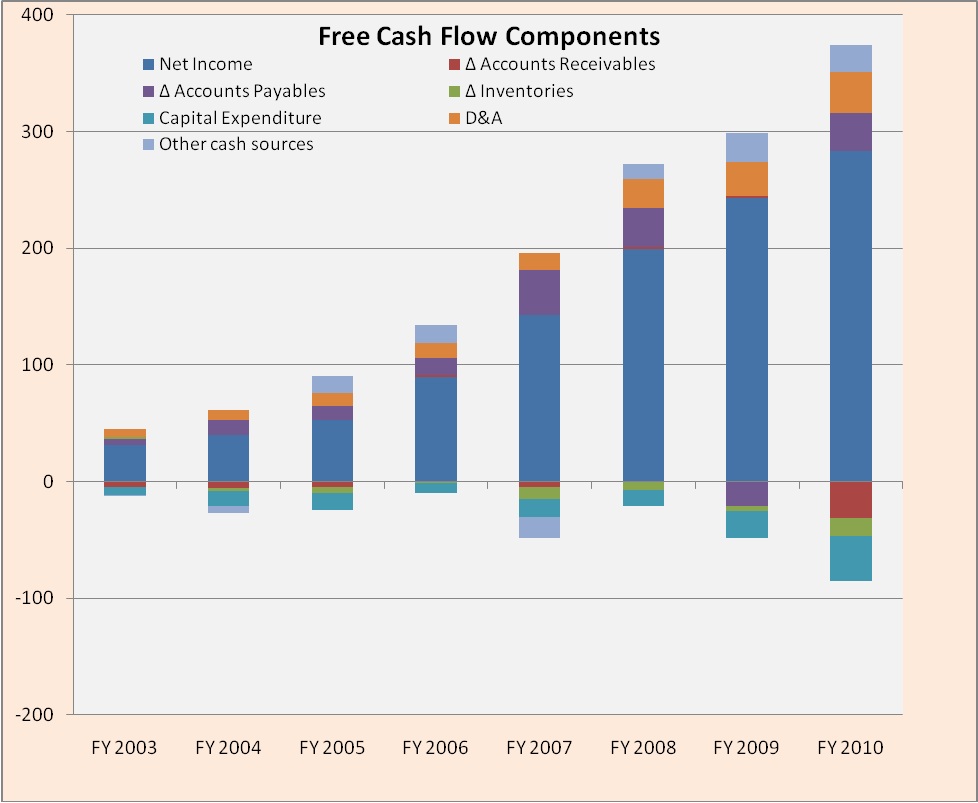

Dolby went public in February 2005 and raised almost $243 million. The company has generated more than $922 million in revenue and 283 millions in net income in last four quarters. The company has a pristine balance sheet with $848 million in cash and short-term investments (or about $7.35 per share) with no debt and minimal operating lease commitments. Gross margin have been growing consistently each year since 2002 from less than 70% to 86% in 2010. In the same time period, return on capital (ROIC) has been hovering in the respectable 15%-20% range.

Research and development expenses — which are critical for Dolby to maintain its competitive edge and position — have grown, in line with revenue. It represents 8%-10% of yearly revenues since 2002. For the recent year, it has inched up to 11% of revenue. I will be keeping an eye on this number. The charts below show the 8 year summary and trend of the company’s financials.

Valuation: What’s it worth?

In last few quarters, the market has already baked in a lot of growth into the stock price. I’m looking for top line growth rates in the 13% range, giving us a value of about $89 in three years compared to the recent $65 price. Dolby is showing some real revenue and earnings strength, despite the talk of double-dip recessions. Using the current numbers, I have valued the company three year down the line.

With a conservative top line growth rate estimate of 13% and current trailing revenues of $922 million, annual revenue by the end of FY 2013 will be $1.31 billion. As they have been pretty consistently in the 28%-35% range for net margin in the past three years, I am using a conservative 29% for my valuation. With this target net margin rate, we get net income of $386 million by the end of FY 2013.

Dolby’s had some pretty hefty share dilution over its public life, averaging almost 6% a year. However that’s slowed considerably in recent years, in fact, being essentially negligible over the past year. Given the recent trend, I have used 1% dilution rate for the next three years. Dolby has 115.4 million shares outstanding so when I factor in our dilution we get estimated shares outstanding of 119 million shares.

So, using net income of $386 million and share count of 119 million shares outstanding, I get estimated earnings of $3.25 per share. Given Dolby’s dominant brand name in its field, healthy balance sheet, high growth potential in emerging markets and new digital devices, I used a target price of 25 to 30 times earnings to reflect the market’s willingness to pay up for Dolby’s profits.

$3.25 x 25 = $81.18

$3.25 x 30 = $97.42

The average of these two prices is $89.30 which makes it somewhat undervalued even at today’s prices. Using my general rule of thumb, I expect a 40% buy-in discount which means I want to buy Dolby again in the $50-$55 range. More aggressive investors might be willing to buy in at higher prices, but its current price is giving us only a 27% discount.

Similarly, my discounted cashflow model spit out an intrinsic value per share in the low 90s. As Dolby is a research driven and intellectual property oriented business, in DCF model, I capitalized R&D. In addition, I took out the value of stock options before calculating per share intrinsic value.

Risks: What can go wrong and when to sell?

Succession risk: Ray Dolby, the founder of the company, has grown this company from a modest beginning in the 1960s to the multi-billion dollar public company it is today. Ray controls more than 90% of the voting shares (consisting of almost all the B shares, which carry a 10-to-1 voting ratio to investors’ A shares). At 76 years young, Ray Dolby may not able to lead the company into many more decades of growth. So, leadership risk is something to watch in future. However, Kevin Yeaman who took over as president and CEO more than in 2009 was CFO of the company for two years and has plenty of experience running businesses successfully.

Technology change risk: On the operating business side, the audio visual entertainment marketplace is changing rapidly. The product mix is changing over time. For example, DVD sales are on the decline whereas Blu-ray, Windows 7 and HDTV sales are on rise. In the near future, the Blu-ray DVD and Windows 7 market is expected to mature and the 3D market is expected to start growing. So far, Dolby has been navigating the quick changing market environment effectively.

Emerging market risk: Investors need to consider the business risks involved for a company that is so heavily dependent on its growth in emerging markets. Because Dolby is in large part a licensing company, its huge gross margins are a product of having the patented technology that others must pay for. It’s dependent on getting those using the technology to actually pay for it. As more of its products are made and sold in China and other developing nations, it has to spend more time and money making sure that it gets paid the royalties that it is owed.

Conclusion: What’s the bottom line?

Dolby has a lot of characteristics that I seek in an investment prospect: a dominant brand name in its field, impeccable financials, high growth potential in emerging markets and new digital devices, and a strong management team with the founder still on board. Given the favorable industry trend and excellent growth prospects over the next 5-10 years, I consider DLB to be a core stock in any portfolio. Though the stock has run up more than 30% in 2010, it is a great buy at temporary pullbacks on short term negative news, e.g., slowing DVD demand or slower economic recovery.

Charts: Historical Financial Overview

(Note: Top picture courtesy waynemah on Flickr)

(Disclosure: As of the publication of this post, I hold long position in DLB. Please read the disclaimer at the bottom of this site.)