Trend Analysis: Digital Entertainment Companies

Posted on 14. Nov, 2010 by TheFreeInvestor in Industry Trend

Last week I wrote a detailed post on my thoughts on the exciting world of digital entertainment. Today, I am going to highlight few of the interesting companies in each of the areas I have highlighted in the previous post. Of course, it is not an exhaustive list. The companies listed here are just the companies I am tracking in this industry.

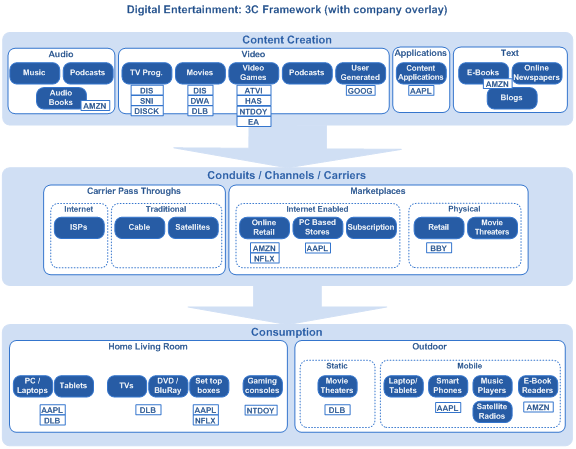

The picture below depicts the notable public companies that are on my radar. Here is an overview of few key companies’ positions in the 3C Framework.

1. Content Creation

Disney (DIS) is a media conglomerate that holds a wide range of assets, e.g., ABC and ESPN television, Pixar studio and Disney theme parks to name a few. The company is poised to benefit from monetize its assets to be sold on new and evolving distribution channels. ESPN delivers the bulk of Disney’s cash flow by raking in by far the industry’s highest affiliate fees at $4.10 per subscriber. With little competition, ESPN will likely increase its moat and continue to generate healthy cashflows.

Scripps Networks Interactive (SNI) and Discovery Communications (DISCK) caters to niche categories of television audience. Scripps owns the Food Network, HGTV, and Travel Channel, while Discovery Communications owns Animal Planet, The Discovery Channel and TLC etc. As technology in the digital entertainment area continues to give more freedom to consumers to choose the specific niche content they want to watch, both these niche segment players are expected to benefit from the growth.

After acquisition of Pixar by Disney, DreamWorks Animation (DWA) is the most prominent pure play animation movie maker in the world. It has a massively successful lineup of movies such as Shrek series, Kung Fu Panda and How to Train Your Dragon etc.

Activision Blizzard (ATVI), Nintendo (NTDOY.PK), Hasbro (HAS), Electronic Arts (EA) are the big players in the video games software market. Among these players, I am most excited about the future of Activision. Its Blizzard unit is the dominant player in the MMPOG (massive multi-player online games) market. The company owns a significant number of top video games, e.g., World of Warcraft, Starcraft and Call of Duty etc. Among the others, Nintendo is a behemoth in software, with seven of the top 10 games, as well as in hardware, with a 43% share of the console market for the widely popular Wii.

Dolby (DLB) provides sound enhancement equipment to creators of contents, e.g., movie makers. Usage of its technology at the early stages helps Dolby to participate in the entire value chain from content creation to end user consumption.

Though Google (GOOG), Amazon (AMZN) and Apple (AAPL) are more dominant in other two Cs, they do play a role in digital content creation too. Amazon’s eBooks are revolutionizing the book publishing industry. In addition, Amazon owns the prominent audio book maker Audible, Inc. As eBook reader become ubiquitous over next few years, Amazon is going to benefit from selling digital books. Google’s YouTube unit is the top brand in user generated videos. Though there is no clear business model to monetize these user generated assets yet, it certainly augments Google’s core search and advertisement based business. In the form of ubiquitous utility applications, Apple has created a new category of digital entertainment through its iTunes store. iPhone/iPad apps (or applications) have flourished over last few years. These apps help Apple and AT&T (T) in locking in users to their platform.

2. Conduits / Channels / Carriers

Netflix (NFLX) is transitioning from its original DVD rental business by mail to a subscriber model for video streaming. Netflix combines its growing library with streaming delivery to lock in recurring subscription revenue.

Amazon (AMZN) is the largest online retailer. It sells everything from DVDs to digital music and video and eBooks. With its Kindle eBooks reader, it practically invented the segment. Though a lot of competing products came up in the Kindle hardware segment, Amazon is expected to benefit from the exponential adoption of eBooks as mainstream content.

iTunes store is home to music, movies, videos, podcasts and applications offered by Apple (AAPL). The user friendly store interface and controlled application environment has kept customers hooked on to Apple iPhones and recently launched iPads.

3. Consumption

Apple (AAPL) is leading the pack of devices used by consumers for media consumption on the go. The aesthetically pleasing and user friendly form factor of Apple products has transformed the mobile media device market. With the introduction of iPad, Apple is changing the tablet computer market. Most importantly, in my view, Apple has created an ecosystem of iTunes store that is seamlessly integrated with its hardware devices. This ecosystem keeps the customers loyal to Apple products.

Amazon (AMZN) is playing in the niche area of singular-use avid book readers. I don’t perceive iPad as threat to Kindle eBooks reader. Though iPad does a lot more things than Kindle, for avid readers who want a book like experience, Kindle still remains as the reader of choice. Recent reductions in price of eBook readers indicate a trend towards lower price points for the reader hardware and accelerating consumption of eBooks.

Dolby (DLB) technologies are standard in a wide range of consumer entertainment devices, including virtually all DVD players, audio/video receivers, and personal computer (PC) software DVD players. With Dolby’s technology already in 100% of American and 80% of European digital TVs, the next wave of transitions will make Brazil, Russia, India, and China the top opportunities over the next three to five years. Dolby’s diverse revenue stream features strong international demand from Windows 7 and 3-D cinema technology, while new avenues for growth include smart phones and tablet notebooks, where Dolby hopes to cement its position as the audio standard. Dolby will benefit from a growing consumer base in emerging markets and TV replacement cycles for years to come.

Netflix (NFLX), as I mentioned before, is transitioning from its original DVD rental business by mail to a subscriber model for video streaming. It combines its growing library with streaming delivery to lock in recurring subscription revenue. Simultaneously, it is expanding is its geographical reach by launching the service in Canada. The company is pushing its content viewing application to a multitude of devices, e.g., game consoles, streaming players, Blu-ray players etc. It is one of the most popular applications on the popular iPad.

Nintendo (NTDOY.PK) captured the casual gamers market with the introduction of Wii gaming console 3-4 years ago. I will be watching their next moves to see where the company is headed.(Top picture by: Capture Queen on Flickr)

Conclusion: What’s the bottom line?

One day in the late 90s, while taking a local train ride across the slums of Indian city Mumbai, I saw poor families living in badly constructed small huts/temporary houses right next to the train tracks. Though the living conditions were miserable, I can see the cable TV lines and color TVs in almost each one of those low income houses. So, whether it’s a multimillionaire with large flat screen 3D TV or a poor family with a smaller color television, it is clear that entertainment plays an important role in people’s lives. As worldwide standard of living continues to improve and channels of content distribution expands and the cost of entertainment keeps dropping with the help of new technologies, I expect the pie of entertainment business, especially digital entertainment, to increase rapidly in years to come.

With the advent of digital entertainment, the landscape of entertainment is changing rapidly. From the old guard, few companies, e.g., Disney, are adapting well to the new world. New business models, e.g., Netflix’s unlimited streaming video, are taking hold in the marketplace. Competitive advantage is increasing for owners-of-ecosystems, e.g., Apple’s iTunes store, Netflix and Amazon’s strong database of customer rating and, therefore, ability to suggest content to the consumers etc.

This nascent market has enormous opportunities that are not fully comprehended by many investors. I believe, we can create a market beating portfolio by investing in the top players of the evolving digital entertainment world.

Disclosure: As of the publication of this post, I hold long position in AMZN, ATVI, DLB, and NFLX. Please read the disclaimer at the bottom of this site.

Trackbacks/Pingbacks

[…] have been analyzing this company for few weeks now. This investment falls into the same category of Digital Entertainment portfolio that I have been building for sometime. The company has three classes of shares. Voting […]