Trend Analysis: The Exciting World of Digital Entertainment

Posted on 07. Nov, 2010 by TheFreeInvestor in Industry Trend

When one of the Motley Fool newsletters (disclosure: I am a subscriber) wrote an one pager overview about the digital entertainment industry, I thought I might as well give some more thought to this trend and come up with a longer write up about the digital entertainment industry. Putting the industry and trend dynamics in paper, or electronic paper for that matter, helps me internalize the industry and its players better. This post is first installment of that write up.

Overview of Digital Entertainment Industry

I am a strong believer in the growth and industry transformational potential of “technology-powered” businesses. For many years now, as a technology insider, I have been a keen observer of the dynamics in the evolving and rapidly transforming digital entertainment landscape.

Over the last five years, living room personal entertainment and consumption of media on multiple devices has increased dramatically. The successes of iPods, smart phones, tablets, HDTVs and video game consoles in recent years are signs of this growing consumption trend. I expect this trend to continue for years or even decades to come. Businesses that have a high competitive advantage in this area will reap the benefit of this growing trend towards personal and home entertainment. Additionally, combining this demographic consumption trend with the well known growth potential of emerging markets is the perfect recipe for success.

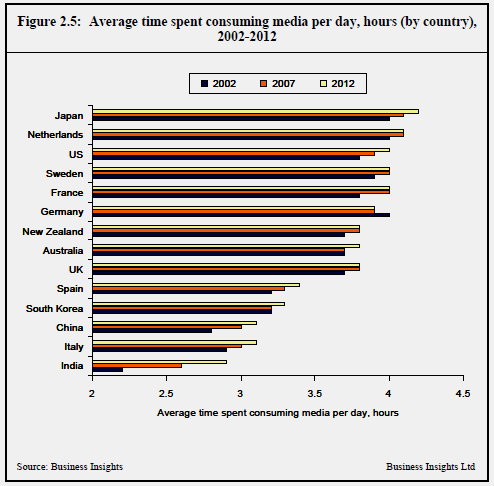

Across the globe, consumption of media per day has been growing slowly but steadily for many years now. The chart below from Business Insight shows historic and projected hours per day spent on consuming media.

Social home entertainment systems, such as the Nintendo Wii, have led to more consumers holding informal gatherings in the home based around video games. Similarly, large flat-screen TVs and HD broadcasts, mean that consumers are happy to gather with friends and family at home to watch major sporting events or to recreate the movie theater experience’ in their own home. With the growing popularity of HD and 3D TV sets, this trend is likely to accelerate. More advanced technology leads to a better home viewer experience, and it can be less expensive than a visit to the bar or restaurant to watch sports on the big HD screen. To put it in context, according to estimates by Business Insight, global sales of 3D TV sets are expected to surge at a CAGR of 80% from 4.2m units in 2010, to reach 78m units sold in 2015.

The future of digital home entertainment is evolving rapidly as technologies, services and content converge around a growing range of devices, inside and outside the home. In the future digital home, content will be the king –– the delivery system, device, time, and the location will be of secondary concern to the consumer. This content will be consumed on a range of converged devices, many of which will be carried outside the home. Content is not confined only to home anymore as consumers expect access to their content wherever they are and whenever they want. At the same time, consumers will pay for this content in multiple ways –– for example, owned content (such as CDs and DVDs), free content (advertising-based), subscription-based models, and ‘on-demand’, one-off payments.

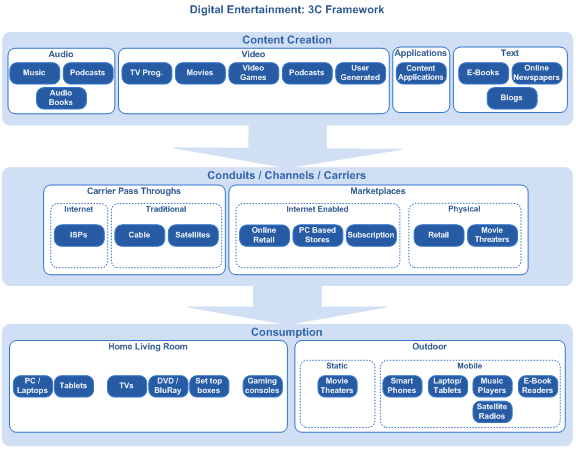

In this context, the follow diagram depicts the landscape of the digital entertainment industry in a framework that I call the 3C framework – Content Creation, Conduits/Channels/Carriers and Consumption.

Detailed Industry Landscape and Trend Analysis

1. Content Creation

In the world of digital entertainment, as it is often repeated, “Content is King”. Over the previous decade, content creation has expanded from traditional sources, e.g., music, movies and, TV programs to additional new sources, e.g., games, podcasts, applications, blogs and e-books etc.

1.1 Audio and Video

Music is still the predominant source of audio content. Podcasts and audio books have proliferated as the new forms of audio content in the last five year. These new audio contents are popular among the fast growing mobile device and smart phone users.

Video content has expanded a lot since the old days of movies and TV programs. In addition to those traditional sources, video games, video podcasts and user generated videos are the new sources of videos. The computing power and video resolution of mobile devices, e.g., laptops, tablets and smart phones has been improving rapidly. Among these, I believe, video games are the most important new content category. Content in this segment is maturing and the gamer experience is becoming more realistic visual experience.

1.2 Applications

In the personal computer era, browsers were the vehicles to consume content on the internet. But, browsers are not very user friendly on the small screens of mobile devices. As an alternative the old browser based functions, direct, made-for-mobile applications have gained immense popularity in the last couple of years. There are already thousands of applications in iTunes and Android Marketplace ecosystems that range from specific niche functions, e.g., a medical drug pronunciation dictionary to widely used applications, e.g., weather forecasts, stock market trackers etc. Apple’s iTunes app store has a reported 250,000 apps available for download and Android marketplace is catching up fast. Though content in this segment is still in the nascent stage, I expect this segment to grow rapidly in the next few years.

1.3 Text

E-books, online newspapers and blogs are the primary sources of content in this category. Since the introduction of Amazon Kindle e-book reader, e-books have been gaining popularity. Recently, Amazon (AMZN) announced that e-books sales have exceeded paperback sales. With the dropping prices of the e-readers, I expect e-books to emerge as a major content category. In addition to the e-books, online newspapers and blogs are examples of the other types of readable contents available.

2. Conduits / Channels / Carriers

Conduits, channels and carriers are the links that connect the content creators with the content consumers. I have categorized these mediums in two sub-categories: pass-through and marketplaces. Marketplaces more interactive and add more value than pure carrier pass-through.

2.1 Carrier pass throughs

Cable networks, satellite networks, telecom networks and internet services providers (ISPs) are the primary types of carrier pass-throughs. Though these players do not add much value to the content, they hold a significant control over the user experience by dictating the nature of service offerings, e.g., bundled TV channels, triple-play etc. Some of the players in this segment have branched into more value added services, e.g., on-demand-movies. However, the primary role of these players is to provide the connection from content providers to end users. Currently, subscription model of pricing is predominant in this segment. Recently many technology savvy consumers have been canceling their cable subscription in favor of viewing online content using their computers or stream it to television using a growing list of set top boxes, e.g., Roku and Apple TV etc. As popularity of watching content online grows, the cable connection provider business model is expected to go through dramatic changes.

2.2 Marketplaces

End users who want to buy or rent their content do so in physical or internet enabled marketplaces. Movie theaters and retails stores are examples of physical marketplaces where users buy entertainment. Internet enabled market places include online retail stores, e.g., amazon.com and PC based marketplaces, e.g., iTunes store of Apple (AAPL). In addition, content is also available through subscription based stores, e.g., Netflix (NFLX).

3. Consumption

Consumption of content segment has been the most exciting and evolving segment in the digital entertainment industry. Consumers are no longer limited to use TV or Movie Theater for entertainment. Content is now available and interoperable across a growing multitude of devices.

3.1 Home living room

TV still remains the central focus of entertainment in the living rooms. However, there are a lot more devices that can feed content to the TV. In addition to cable or satellite connections, gaming consoles, DVD players, Blu-Ray players and set top boxes are some of the devices that feed the content to TV. As per Entertainment Software Association, 67 percent of US households play computer or video games and, contrary to popular belief that gamers are teenagers, average age of video game players is 34 years, with one in every four gamer is 50 years or older.

Consumption of video on PCs, laptops and tablets has been gaining traction too. Especially, the younger generations of users tend to use computers, as opposed to TVs, as the primary entertainment device at home. According to a recent survey undertaken by Dolby (DLB), approximately 60 percent of college students in the United States are now powering up their PCs, and not their televisions, for their entertainment fix. The majority of students also believe PCs deliver the best overall entertainment experience, with 70% using their PCs to watch video, and for 64% this was communal, shared with other viewers, versus 44% in the general population.

3.2 Outdoor

The outdoor mobile device segment has been the most dynamic segment in last few years. Starting with the iPods that revolutionized the portable digital music player market, we have a plethora of ever improving mobile devices – smart phones, laptops/tablets, music players, satellite radios and e-book readers. These devices are capable of delivering a lot more content than the original iPod music player. With the increases in computing power, storage capacity and screen resolutions, these devices are capable of playing high quality videos and games.

The proliferation of “apps” / applications in the smart phones or tablets is a fast growing trend. These applications are delivering content directly from service providers to end users without the use of browsers. From a user perspective, these applications increase the utility of the mobile devices and increase customer loyalty.

In the next post, I will talk about some of the interesting companies in the digital entertainment world and wrap up the trend analysis.

(Top picture by: SSH on Flickr)

Disclosure: As of the publication of this post, I hold long position in AMZN, DLB, and NFLX. Please read the disclaimer at the bottom of this site.

Trackbacks/Pingbacks

[…] week I wrote a detailed post on my thoughts on the exciting world of digital entertainment. Today, I am going to highlight few of the interesting companies in each of the areas I have […]

[…] wrote a detailed overview of the trends in the digital entertainment industry in a previous post. In this context, there is a growing trend towards consumption of more and more rich content at […]

[…] showed up in the result of this screen. As I looked over the list, few of the companies in the digital entertainment world caught my eye. These companies are – Activision Blizzard […]