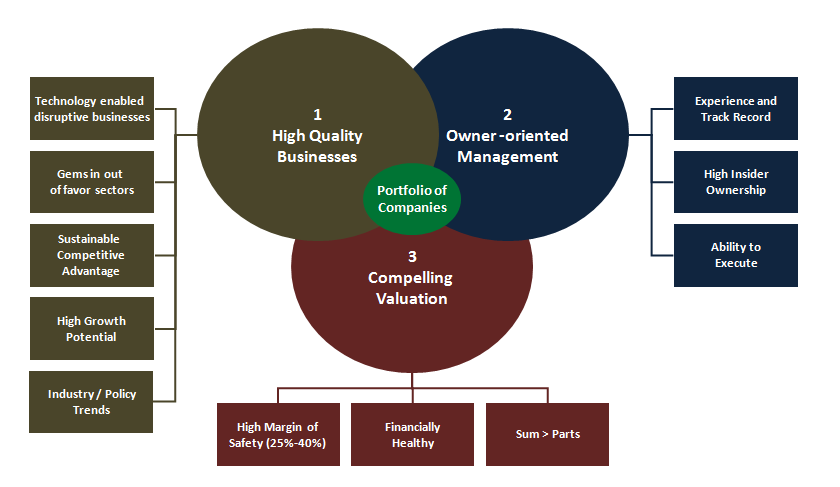

Three Dimensions of Valuation

Posted on 30. Oct, 2010 by TheFreeInvestor in Investing Philosophy

In the last two posts, I covered two aspects of investing – quality of business and quality of management of the firm. This post is devoted to the third and final aspect – financials and valuation. Valuation can be a fun exercise to do. But, due to the mathematical nature of the exercise, too much reliance on precise valuation may turn out to be dangerous to the investing decision. You input a few number and … boom …. the model spits out a number. This precise number has a psychologically comforting influence on our thought process. Valuation is mostly derived from a bunch of “estimations”. It’s a rough estimate of value rather than a true value number. So, to mitigate this false comfort in valuation, I try to create a range of valuations with optimistic, realistic and pessimistic projections. Here are three dimensions to keep in mind when thinking about financials and valuation of a firm:

1. High margin of safety

Making sure there is a high margin of safety is one of the most critical aspects of investing decision. Seth Klarman, one of my favorite investors, has written a book about it that sells for $1,000 in used books market ! The profit we make on a stock depends on at what price we buy the stock. Every investor is going to make mistake in valuation at some point in their investing career. So, having a high enough margin of safety makes sure that we don’t lose too much even if the original valuation was off the mark. Typically, I try to look for buy-in price at approximately 40% discount to my weighted average valuation of the optimistic, pessimistic and realistic scenario. However, I admit that I have bought initial/starter stock position with less than 40% margin of safety when I find a great business run by a top class management and the stock is selling at a fair price. My investment in Amazon (AMZN) is a good example of buying a growth stock at relatively low margin of safety. In cases like Amazon or Google, if we wait for 40% discount to our estimated value, we may never be able to buy the stock or miss a large part of the price appreciation. A lot of strict value investors will be uncomfortable with this approach. However, as I mentioned in my profile page, I don’t place myself in stick value, growth, small cap or large cap category. When I find a great business, I would rather buy a starter position, may be one third or half of my target allocation, at a fair price rather than wait for ever for 40% – 50% discount. But, in most other cases, I look for a a good 30%-40% margin of safety.

2. Impeccable financial health

The best way to understand the financial health of a company is to pour over the financial statements and SEC filings. As I invest a lot in technology enabled businesses, many of my companies do not have substantial debt load. A healthy level of leverage can be a good thing for return on equity. But, in turbulent times like what we have seen since 2008, a debt free balance sheet is a good downside protection. My no or low debt investments include Cognizant Technology (CTSH) and Dolby Laboratories (DLB), both have done pretty well during this recession. Again, typical debt levels vary depending on the capital intensity of the industry. For example, my investments in Oil and Gas sector have a healthy dose of debt. Apart from debt levels, I look at a variety of metrics to ensure well being of the companies. Some of my frequently used metrics include return on invested capital (ROIC), free cash flow (FCF) growth, margins (gross margin, operating margin etc), inventory and receivable level ratios etc. I will elaborate on some of the key metrics in later posts.

3. Value of the sum of the parts greater than current price

Once in a while, market presents us with an opportunity to buy a company at a cheaper price than what it’s parts are worth. These are typically asset plays. In recent time, when the BP rig in Gulf of Mexico blew up, market pulled down the stock prices of many related and unrelated oil and gas companies. ATP Oil and Gas (ATPG) was one such opportunity at that time. Of course, the company had and still has an uncomfortably high level of leverage, but the stock was trading at a much lower enterprise value than the value of its proven reserves and infrastructure. I am not a big fan of asset plays. But, during turbulent times in the market, investing in asset plays can prove to be very profitable once the market returns to sane levels.

Finally, it is difficult, almost impossible to find investments that meet all the criteria that I listed in last three posts. The fun of investing is in finding that right balance of characteristics to look for and be disciplined in making investing decisions.

Let me end this series of posts on investing approach with this picture that sums it all up:

(Note: Click on the image to see a larger view)

Disclosure: As of the publication of this post, I hold long position in AMZN, CTSH, DLB, and ATPG. Please read the disclaimer at the bottom of this site.